Is IVF Covered by Insurance? Your Guide to Understanding Coverage, Costs, and Options

In vitro fertilization (IVF) is a life-changing option for many people dreaming of starting a family. But with costs that can climb into the tens of thousands of dollars, one big question looms large: Will insurance help cover it? If you’re exploring IVF, you’re not alone in wondering about this. Millions of Americans face infertility challenges every year, and figuring out the financial side can feel overwhelming. The good news? Coverage is evolving, and there are ways to make it work. The not-so-good news? It’s complicated, and it depends on where you live, who you work for, and what plan you have.

This guide dives deep into everything you need to know about IVF and insurance in 2025. We’ll break down how coverage works, what’s changing, and what you can do if your plan falls short. Plus, we’ll uncover some lesser-known tips and trends—like how employers are stepping up and what new laws might mean for you. Whether you’re just starting to research or you’re ready to take the next step, stick around. This is your roadmap to navigating IVF costs with confidence.

What Does IVF Coverage Actually Mean?

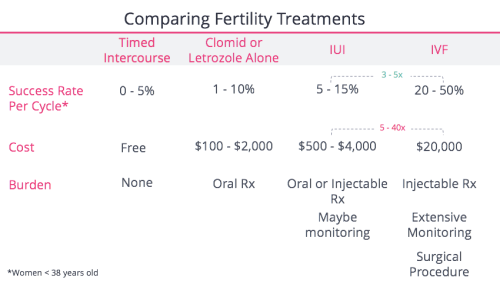

IVF isn’t a single procedure—it’s a process with multiple steps, from hormone shots to egg retrieval to embryo transfer. When we talk about “coverage,” it’s not always an all-or-nothing deal. Insurance might pay for some parts but not others, or it might cap how much it’ll help. Understanding what’s included is the first step to figuring out your options.

Typically, IVF involves:

- Medications: Drugs to stimulate egg production can cost $3,000-$5,000 per cycle.

- Monitoring: Ultrasounds and blood tests to track progress, often $500-$1,000.

- Egg Retrieval: A surgical procedure that might run $5,000-$7,000.

- Fertilization and Embryo Transfer: Lab work and the final step, adding another $3,000-$5,000.

Some plans cover diagnostics (like tests to figure out why you’re struggling to conceive) but stop short of treatments like IVF. Others might offer a lifetime maximum—say, $15,000—while a full cycle can easily hit $20,000 or more. So, even with “coverage,” you might still face big out-of-pocket costs.

Here’s a quick reality check: According to the American Society for Reproductive Medicine (ASRM), about 1 in 8 couples in the U.S. deal with infertility. Yet, insurance coverage for treatments like IVF isn’t guaranteed. It’s a patchwork system, and where you live or work can make all the difference.

Does Your State Mandate IVF Coverage?

Where you live plays a huge role in whether insurance covers IVF. As of April 2025, 21 states and Washington, D.C., have laws requiring some form of infertility coverage. But here’s the catch: not all of them include IVF, and the rules vary wildly.

States That Cover IVF

Fifteen states explicitly require IVF coverage under certain conditions. Here’s a snapshot of some standouts:

- Connecticut: Covers IVF for people unable to conceive after a year (or six months if over 35).

- Illinois: Mandates up to four egg retrievals if you work for a company with 25+ employees.

- New Jersey: Requires three IVF cycles for large group plans (over 50 employees) as of 2024.

- New York: Offers three cycles for large groups, but only if your plan isn’t self-insured.

States That Don’t

If you’re in a state like California (until mid-2025) or Alabama, there’s no mandate yet. California’s new law, starting July 2025, will require large group plans to cover IVF, but it won’t apply to everyone. And in states without laws, you’re at the mercy of your employer or insurance provider.

Why It’s Not That Simple

Even in “mandate” states, there are loopholes:

- Self-Insured Plans: About 61% of workers with employer-sponsored insurance are on self-insured plans, which are exempt from state laws under federal rules (ERISA). Your state might require IVF coverage, but your job might not have to follow it.

- Small Businesses: Companies with fewer than 50 employees often aren’t required to offer health insurance, let alone IVF benefits.

Want to know where you stand? Check your state’s insurance department website or call your plan’s member services. It’s worth a quick look—your wallet will thank you.

How Employers Are Changing the Game

If state laws don’t help, your job might. Employers are increasingly adding IVF benefits to attract and keep talent, especially in competitive fields like tech and finance. In 2023, 45% of companies with 500+ employees offered IVF coverage, up from 27% in 2020, according to Mercer’s annual survey. For big players with 5,000+ workers, that number jumps to 70%.

Real-Life Examples

- The Federal Government: Starting in 2024, federal employees get up to $25,000 annually for IVF through plans like Blue Cross Blue Shield. With 2.1 million workers, it’s a massive shift.

- University of Michigan: Added IVF coverage in 2015 with a 20% coinsurance. Result? IVF use spiked, especially among lower-salary workers.

- Tech Giants: Companies like Google and Amazon often cover multiple cycles, sometimes up to $75,000 lifetime.

Why It Matters

Employers see the value: 97% say adding IVF doesn’t jack up medical costs significantly, and it boosts loyalty. In a tight job market, it’s a win-win. But here’s the flip side—smaller companies might not have the budget, leaving their workers high and dry.

Quick Tip: Ask HR about fertility benefits during your next open enrollment. Some plans hide these perks in fine print, so don’t assume they’re not there!

What If Your Insurance Says No?

No coverage? Don’t lose hope. There are ways to make IVF more affordable, even if your plan won’t budge.

Option 1: Switch Plans or Jobs

If your current plan doesn’t cover IVF, look at other options during open enrollment. Some employers offer multiple plans—one might include fertility benefits. Or, if you’re job hunting, prioritize companies with strong family-building perks. Sites like Maven Clinic list employers with IVF coverage—worth a peek.

Option 2: Financing Programs

Clinics and third parties offer payment plans to spread out costs:

- Future Family: Loans tailored for fertility treatments, often with lower interest than credit cards.

- ARC Fertility: Bundles IVF cycles at a discount, sometimes with financing.

Option 3: Grants and Discounts

Nonprofits like Baby Quest or the Tinina Q. Cade Foundation offer grants up to $15,000. Clinics might also give discounts if you pay upfront or qualify based on income.

Option 4: Move to a Mandate State?

Extreme, yes—but some people relocate for better coverage. A 2024 X post from a user in Texas joked, “Moving to NJ for IVF coverage—wish me luck!” It’s not practical for everyone, but it shows how desperate the need can be.

Action Step: Call your clinic’s financial counselor. They often know about local resources or payment tricks you won’t find online.

The Cost Breakdown: What You’re Really Paying For

IVF’s price tag is intimidating, but breaking it down helps. Here’s what a typical $20,000 cycle might look like without insurance:

| Component | Cost Range | What It Covers |

|---|---|---|

| Medications | $3,000-$5,000 | Hormone shots to boost egg production |

| Monitoring | $500-$1,000 | Ultrasounds, blood tests |

| Egg Retrieval | $5,000-$7,000 | Surgery to collect eggs |

| Lab Fees | $3,000-$5,000 | Fertilization and embryo growth |

| Embryo Transfer | $1,500-$3,000 | Placing embryo in uterus |

| Storage (optional) | $500-$1,000/year | Freezing extra embryos |

Add-ons like genetic testing ($2,000-$5,000) or donor eggs ($10,000+) can push it higher. And most people need 2-3 cycles for success, so costs stack up fast.

A Hidden Cost: Time Off Work

One thing rarely talked about? Lost wages. IVF appointments mean missing work—sometimes days at a time. A 2023 study from KFF found patients spent thousands on top of medical bills just covering travel and time off. If your job doesn’t offer paid leave, that’s another hit.

Interactive Quiz: Is IVF Coverage Right for You?

Wondering if your situation aligns with typical coverage? Take this quick quiz (circle your answers mentally):

- Do you live in a state with an IVF mandate?

- A) Yes

- B) No

- Is your employer self-insured?

- A) Yes (check with HR if unsure)

- B) No

- Does your plan cover infertility diagnostics?

- A) Yes

- B) No

- Are you willing to switch jobs or plans for benefits?

- A) Yes

- B) No

Results:

- Mostly A’s: You’ve got a decent shot at coverage—dig into your plan details!

- Mostly B’s: Coverage might be tough, but explore financing or grants.

This isn’t scientific, but it’s a starting point to gauge your odds.

New Trends in IVF Coverage for 2025

The landscape is shifting fast. Here’s what’s new and what it means for you.

Federal Push for IVF Access

In 2024, Donald Trump pledged to mandate IVF coverage if re-elected, saying, “We’re going to pay for it, or your insurance will.” It’s unclear how that’d work—Congress would need to act, and opposition is fierce. Still, it’s sparked buzz. X users are split: some cheer the idea, others worry about higher premiums for all.

State-Level Updates

- California’s Big Move: Starting July 2025, large group plans must cover IVF. It’s a game-changer for millions, though self-insured plans are still exempt.

- D.C.’s Expansion: As of 2025, D.C. Health Link plans cover three IVF cycles plus surrogacy costs—a rare win for comprehensive care.

Employer Innovations

Some companies now offer “fertility stipends”—cash you can use for IVF, egg freezing, or adoption. Starbucks, for example, gives part-time workers $10,000 toward family-building. It’s not insurance, but it’s flexible.

What to Watch: If federal mandates stall, expect more states and employers to fill the gap. Google Trends shows “IVF insurance coverage” searches spiking in early 2025—people are paying attention.

Three Under-the-Radar Factors Affecting Coverage

Most articles skip these, but they’re critical to understanding your options.

1. Your Age Isn’t Always a Barrier

Think you’re too old for coverage? Not necessarily. While some plans cap IVF at 42, states like New Jersey banned age restrictions in 2024. Clinics report success rates drop after 35, but a 2023 ASRM study found 20% of women over 40 still conceive with IVF. If your plan covers it, age might not stop you.

2. Single and LGBTQ+ Families Are Gaining Ground

Historically, IVF coverage required a medical infertility diagnosis—tough for single people or same-sex couples. Now, states like New York and Illinois ban insurers from denying based on marital status or orientation. A 2024 X trend showed #IVFEquality posts soaring as advocates push for inclusivity.

3. Fertility Preservation Is Sneaking In

Freezing eggs or embryos before cancer treatment (or just to plan ahead) is covered in 17 states. But here’s the twist: some plans now extend this to IVF storage costs mid-cycle, saving you $500-$1,000 yearly-—a small win if your plan includes it.

Your Action Plan: Steps to Get Started

Ready to figure out your coverage? Here’s a simple guide:

- Call Your Insurance: Dial the number on your card. Ask: “Does my plan cover IVF? What about diagnostics or meds?” Write down what they say.

- Talk to HR: Ask about fertility benefits or self-insured status. Don’t be shy—HR’s there to help.

- Check State Laws: Google “[Your State] IVF insurance laws” for the latest rules.

- Contact a Clinic: Schedule a consult. They’ll often run a free insurance check for you.

- Explore Backup Plans: Look into grants or financing if coverage falls short.

Pro Tip: Keep a notebook for all this. It’s easy to lose track of details.

Real Stories: What IVF Coverage Looks Like in Action

Sometimes, hearing from others makes it click. Here are two quick examples:

- Sarah, 34, Illinois: “My plan covered three cycles, but only after two failed IUIs. It still cost me $6,000 out of pocket for meds and extras. Worth it—my son’s two now.”

- Mike, 38, Texas: “No mandate here, and my job’s self-insured. We paid $22,000 for one cycle. Took out a loan, but our twins are priceless.”

These show the range—coverage helps, but it’s rarely free.

Poll: What’s Your Biggest IVF Worry?

Weigh in below (mentally tally your vote):

- A) Cost

- B) Insurance confusion

- C) Success rates

- D) Emotional stress

Drop your pick in the comments if you’re reading this on a blog! It’s anonymous, and I’d love to hear.